The ASX’s dual-listed giants are increasingly disappearing overseas

Australian Financial Review

30 April 2025

The number of locally held shares in Australian companies that have switched their primary listing to an overseas exchange has more than halved within years and is still falling, raising concerns from investors that an increase in dual listings is driving a wider drain from the ASX.

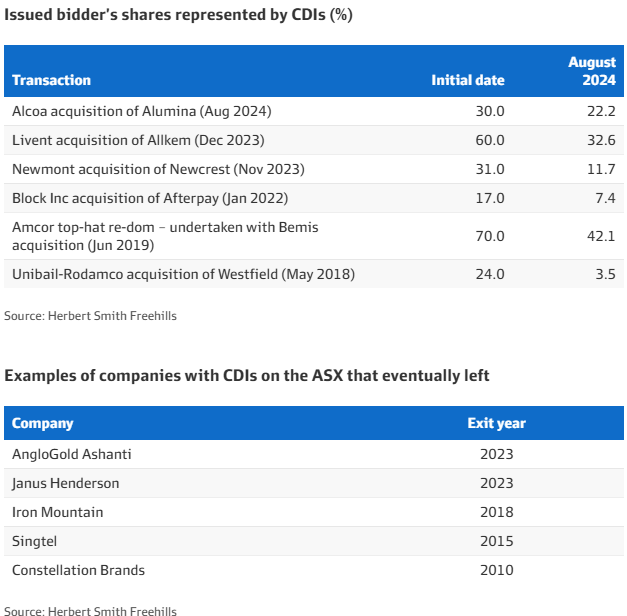

Figures compiled by the sharemarket operator show the number of local shares in Newmont, which merged with Australia’s largest gold producer, Newcrest Mining, in November 2023, now make up just 11.7 per cent of the register. Shares in Australia had accounted for 31 per cent of the merged company, which has a primary listing in New York.

“In a way, it’s like a pre-paid funeral,” said Ross Illingworth, the executive director of Kingfisher Capital Partners. “[Keeping a secondary local listing is] a way of appeasing shareholders. It’s a comfort factor.”

Building materials giant James Hardie, which listed in Australia in 1951, has proposed shifting its primary listing to New York once it completes its controversial buyout of American outdoor decking and railings company Azek. The company told investors it would not delist from the ASX without shareholder approval or request an exemption from local listing rules.

Amcor, the packaging giant which shifted its primary listing to New York in 2019 when it acquired its rival Bemis for $9 billion, is due to settle an even bigger purchase of American group Berry on Wednesday. The $13 billion transaction is entirely share-based, meaning even more of the consolidated company will be held by investors in the United States. Since Amcor re-domiciled to the US after the Bemis acquisition, the number of locally listed shares, or Chess Depositary Interests, has fallen 40 per cent.

Chess Depositary Interests, better known as CDIs, can be converted for shares on the overseas exchange, reducing volumes on the ASX and making it more difficult for investors to trade. Eventually, some companies abandon the ASX altogether. Singtel delisted from the ASX in 2015 – it had been listed as a CDI for 14 years after the Singaporean telecoms group acquired Optus – while Janus Henderson, a fund manager, left the local bourse in 2023.

Flowback fallout

Rodd Levy, a partner at Herbert Smith Freehills, described the phenomenon as flowback and said it was an inevitable result as investors seek to trade their shares on the market with the most liquidity.

“Local investors may lose interest for other reasons such as reduced index weighting, lack of dividend franking and less media coverage of foreign companies, which adds to the pressure,” he said. “Once the CDI proportion declines, and that often happens within a couple of months, it seems to accelerate. There is a snowballing effect and, at some point, maintaining the ASX listing of CDIs is not worth the effort or cost.”

Levy said in most cases there was a 25 per cent to 50 per cent decline in the proportion of CDIs in the first two months after implementation of a deal.

Block shares, for instance, traded on the ASX after the company acquired Afterpay in a $38 billion scrip deal in late 2021. At the time, about 17 per cent of the merged company’s shares were listed on the ASX. By August last year, that number had fallen to just 7.4 per cent, and continues to fall.

One of the most prominent Australian companies to be listed locally through a CDI is News Corporation, the Murdoch family-run media giant behind a string of newspapers around the world. The number of Class A shares, which have fewer voting rights, represented by ASX-listed CDIs fell 78 per cent between May 2019 and the end of March this year.

Similarly, France’s Unibail-Rodamco purchased Westfield, the Lowy family-founded international shopping centre giant, in 2018 with a $32 billion deal that was largely share-based. While the company is primarily listed in Paris, CDIs continue to trade on the ASX. The number of CDIs as a proportion of the register slid from 24 per cent to just 3.5 per cent by late last year.

Hasan Tevfik, a strategist at MST Financial, said the growth of Australia’s superannuation system meant there should be more demand for CDIs. But, he added, distant management made that more difficult.

“On average, the CDI just withers. Management more or less plonk themselves offshore and they essentially become overseas companies,” Tevfik said. That meant outreach to local investors fell away.

There are some notable exceptions, however.

An exception is sleep device company ResMed, dual-listed in New York and on the ASX, where it has CDIs trading and is closely followed by fund managers and investors. Life360, the San Diego-based family tracking app, is listed on both the ASX and Nasdaq. The number of CDIs increased 26 per cent between May 2019 and the end of March this year.

The number of CDIs for ResMed, which makes devices to treat sleep apnoea, has increased 42 per cent in the same period, ASX data shows.